Battery markets and predictions 2030

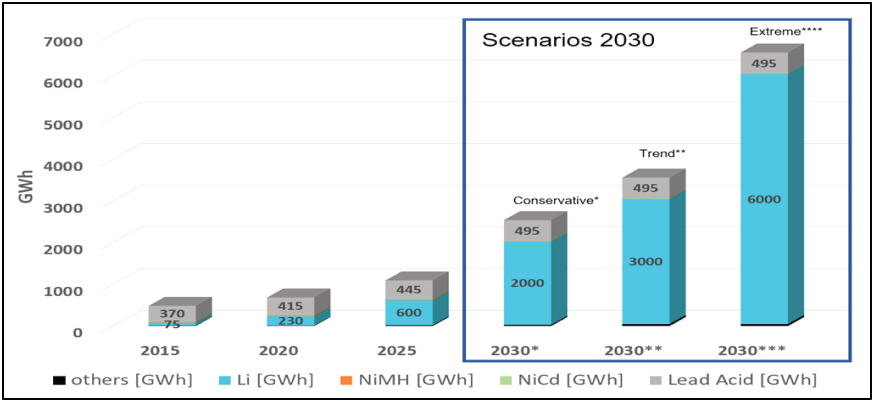

There are many credible sources predicting different battery market trends in different scenarios. For EUROBAT, a realistic scenario for the evolution of the total worldwide battery market is a five-fold market growth, from 645 GWh in 2020 to 3,495 GWh in 2030. The chart below represents the worldwide battery market per technology. This shows that lead and lithium batteries will remain the dominant technologies in the market through to 2030, with volumes of lead and lithium batteries on the world market reaching 495 GWh and 3,000 GWh, respectively

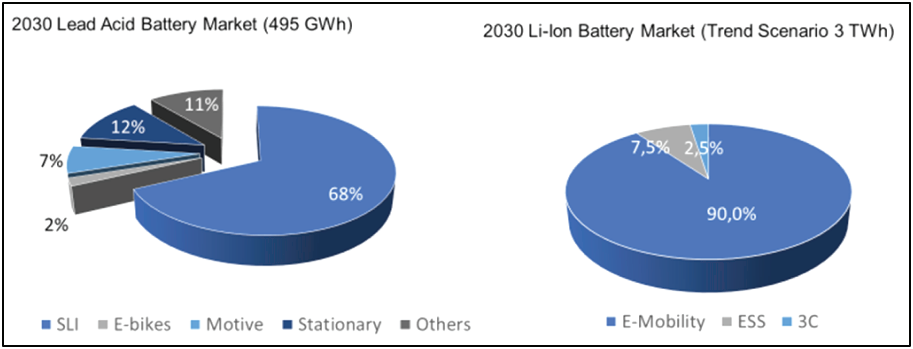

Further segmentation of the lead and lithium battery market is provided in the chart below.

These charts give a first indication that the mainstream battery technologies will remain complementary through to 2030:

• Lead batteries (495 GWh) will serve the 12V SLI and 12V auxiliary automotive applications, followed by specific applications in motive power and stationary energy storage, in particular UPS and telecom markets.

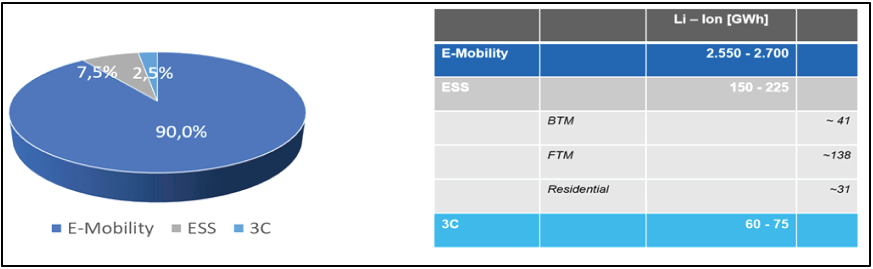

• Lithium batteries (3,000 GWh) will largely serve the e-mobility automotive power segments (xEV batteries), representing 85-90% of the total volume, but also energy storage markets, which will reach 150-225 GWh by 2030, of which 41 GWh will be behind-the-meter (BTM), 138 GWh front-of-the-meter (FTM) and 31 GWh for residential storage (see chart below).

It should be noted that current predictions on large-scale ESS do NOT take into account the European Commission’s recently announced RePowerEU Plan in response to global energy market disruptions. REPowerEU was initially created to end the EU’s dependency on fossil fuel imports and will reinforce the Commission’s Fit for 55 plan to cut emissions by at least 55% by 2030. The synergy of both plans will considerably accelerate the building of Europe’s clean energy infrastructure. In this context the Commission is proposing to increase the EU’s 2030 target for renewables from the current 40% to 45%, which would bring the total renewable energy generation capacities to 1,236 GW by 2030 (compared to 1,067 GW by 2030 under Fit for 55). These new objectives will impact our market projections for the stationary storage battery markets and, in particular, for large-scale ESS.